April Recap and May Outlook

April began with the shock of tariff announcements that were much more punitive than anticipated by businesses, markets, investors, and economists. Equity markets promptly pulled back, even entering bear territory, although not closing there.

The administration initially stood by the tariff enactment date. However, the bond markets became increasingly wobbly, and fears increased that plummeting bond prices and skyrocketing yields – instead of the flight to safety that would have been expected given the rout in the equity markets and the move to a “risk-off” stance – indicated a massive loss of confidence in the U.S.

Market practioners began to fear an imminent recession, and the futures markets predicted rate cuts at each of the remaining four meetings in 2025, with the closest two – June and July – at 90%+ probability. Fed Chairman Jerome Powell stated in a speech that higher tariffs would likely increase inflation, and that uncertainty had increased. This was generally interpreted as a sign that the Fed would not ride to the rescue of the economy (and the markets) at the expense of the long-fought campaign against inflation.

On April 9th, the administration announced a 90-day pause on tariffs, with the exception of China. Markets breathed a short sigh of relief, but uncertainty remained. The release of negative GDP data at month end showed the depth and breadth of the immediate impact on businesses and their outlooks and plans for 2025.

Let’s get into the data:

- Inflation, as measured by CPI, eased more than expected. CPI fell 2.4% for the 12 months ended in March. The monthly number fell 0.1%.

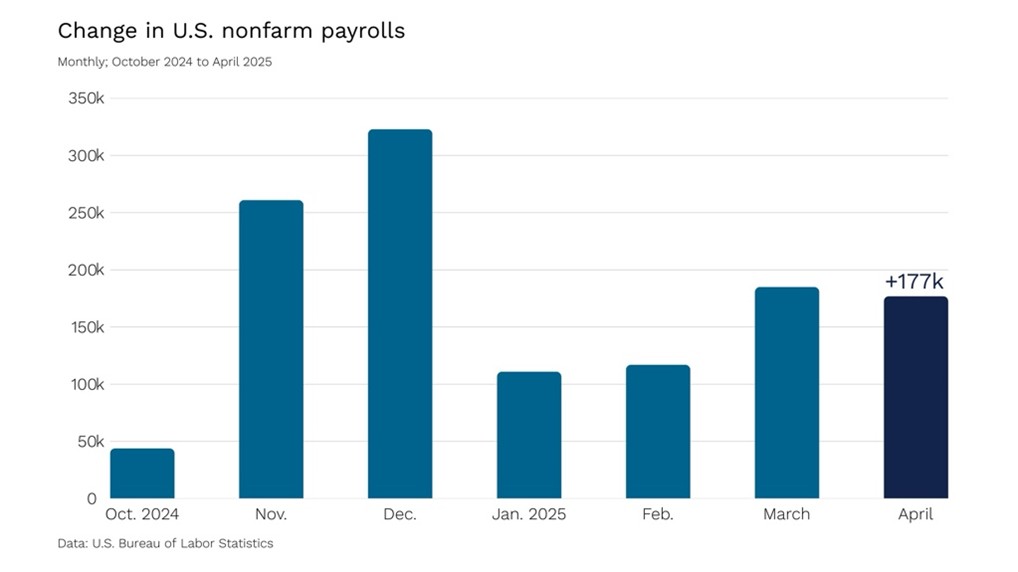

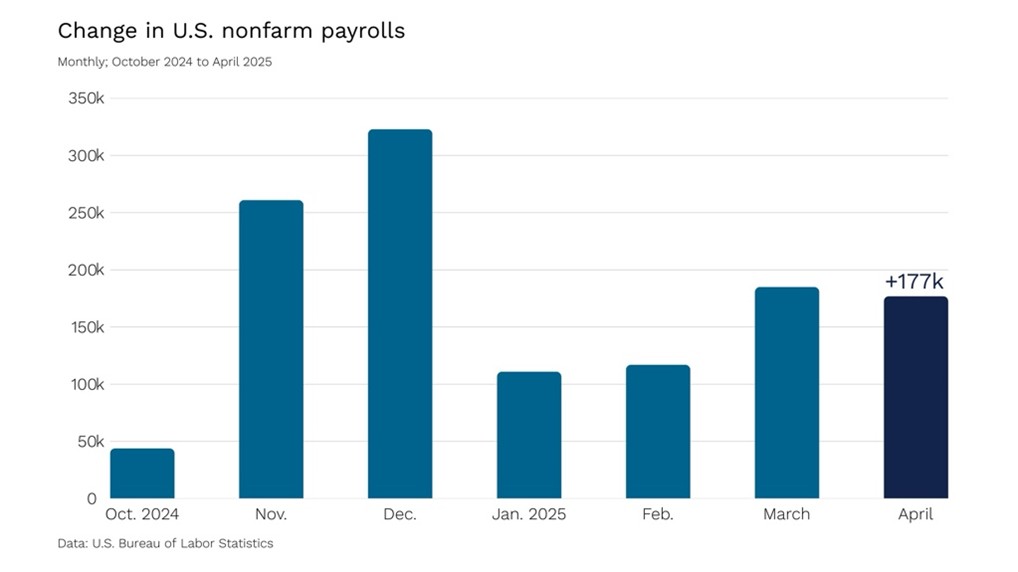

- Non-farm payrolls for April came in at 177,000. The U.S. Bureau of Labor Statistics reported that the labor market remains solid, with almost 40,000 more jobs than the 138,000 that were expected, and the unemployment rate stayed at 4.2%.

- Consumer Confidence plunged in April The Conference Board Consumer Confidence Index® declined by 7.9 points in April. This marks a 13-year low in consumer’s expectations for the future.

- GDP turned negative. GDP fell at a 0.3% annualized rate in Q1, instead of the 0.4% increase expected by economists surveyed by Dow Jones.

What Does the Data Add Up To?

Actual data releases throughout the month, including the Fed’s “Beige Book” showed that the economy was holding steady and even slightly up in some areas. This provided reassurance that the economy had entered the new era of disruption caused by tariffs with a solid foundation, but it was not enough to stave off fears that the extent and the business paralysis resulting from the uncertainty would propel the country into recession in the near term, usually interpreted to mean by the summer. Fears that the recession would begin at the Port of Los Angeles, as ships stopped arriving from China, and spread from there began to be the accepted scenario.

GDP went from a gain of 2.4% in Q4 2024 to a negative of 0.3% in the first quarter of 2025. The estimate was for a slight increase, but a massive growth in imports as businesses attempted to stock inventory before tariffs went into effect resulted in the negative, as imports are subtracted from GDP. Imports grew 41.3% in the first quarter, with most of that coming from a 50.9% increase in goods. The last time growth in imports hit this level, except for the COVID pandemic, was in 1974. This will likely reverse in the second quarter, as imports will likely drop off substantially.

However, there are other inputs that are unlikely to improve. Consumer spending is trending down, and declines in government spending, given layoffs and funding cuts, are likely to continue.

The strong labor market helps make the case that recession is not as close or as likely as feared, given the overall resiliency of the economy. The unemployment remained steady at 4.2%, and labor force participation ticked higher.

What did this look like the last time it happened? In 1974, U.S. Gross National Product was declining by 4.2% annually, inflation hit 16.8%, and unemployment was 8.9%. Despite two successive administrations attempting to fix the problem, stagflation remained throughout the 1970s. The cure was the aggressive interest rate regime of Fed Chairman Paul Volker.

The Federal Open Market Committee met during the first week of May and kept rates unchanged. In the official stated, language was added to note that “the risks of higher unemployment and higher inflation have risen. Powell noted in his speech that “despite heightened uncertainty, the economy is still in a solid position.” This would seem to indicate that the Fed will maintain the position of not making pre-emptive cuts to rates and will instead wait for the data.

The 90-day window until tariffs go into effect – or are kicked down the road again, to more uncertainty, is still running down. However, the administration unveiled the outline of an agreement with England on May 8th. It left the 10% tariff in place, which, given the “special relationship” between the U.S. and U.K., would seem to set a floor on tariffs for other countries as being no lower than 10%. Early on Monday May 12th, the U.S. and China announced an agreement to lower reciprocal tariffs for 90 days. This may push the threat of recession back substantially, even if uncertainty and volatility remain.

Chart of the Month: A Strong Labor Market Belies Recession Fears, For Now

Source: Bureau of Economic Analysis

Equity Markets in April

- The S&P 500 was down 0.76% for the month

- The Dow Jones Industrial Average fell 3.17% for the month

- The S&P MidCap 400 decreased 2.32% for the month

- The S&P SmallCap 600 lost 4.28% for the month

Source: S&P Global. All performance as of April 30, 2025.

Five of the eleven S&P 500 sectors had positive returns, with Information Technology contributing 1.58% and Energy in last place, down 13.73%. The month saw 11 of 21 trading days moving at least 1% up or down, and 8 days of at least 2% moves. Monthly intraday volatility, measured as the daily high/low, increased to 3.21% in April from March’s 1.71%.

Bond Markets in April

The 10-year U.S. Treasury ended the month at a yield of 4.18%, down from 4.22% the prior month. The 30-year U.S. Treasury ended April at 4.69%, up from 4.58%. The Bloomberg U.S. Aggregate Bond Index returned 0.39%. The Bloomberg Municipal Bond Index returned -0.81%.

The Smart Investor

Even if tariffs begin to find a floor and the trade war begins to move toward the off-ramp, volatility will likely continue given the shock to the system and the messaging from the administration. What can investors do to insulate their plans and keep their goals on track?

Stick to the tried and true. Continue to save, but as rates stay higher, consider moving saving into high-yield savings accounts, and then using dollar-cost averaging to leg into the market. While tax loss harvesting is usually a year-end rebalancing tool, there may be opportunities to take advantage throughout the year. A long-term investment strategy is built for situations like this, and there are tools and strategies that can be deployed to mitigate downturns and maximize opportunity.

The sum of your investment plan is not equal to the amount your portfolio goes up or down. Financial planning takes into account all aspects of your financial life, and many aspects of your personal life.

Combining personal goals, investments, and a view on the economy, while ensuring that all the pieces of the financial planning process are engaged, is at the core of what a financial advisor can bring to the table. We’re always here to help.

May Market Commentary – Does Volatility + Uncertainty Equal Recession?

May Market Commentary – Does Volatility + Uncertainty Equal Recession?

April Recap and May Outlook

April began with the shock of tariff announcements that were much more punitive than anticipated by businesses, markets, investors, and economists. Equity markets promptly pulled back, even entering bear territory, although not closing there.

The administration initially stood by the tariff enactment date. However, the bond markets became increasingly wobbly, and fears increased that plummeting bond prices and skyrocketing yields – instead of the flight to safety that would have been expected given the rout in the equity markets and the move to a “risk-off” stance – indicated a massive loss of confidence in the U.S.

Market practioners began to fear an imminent recession, and the futures markets predicted rate cuts at each of the remaining four meetings in 2025, with the closest two – June and July – at 90%+ probability. Fed Chairman Jerome Powell stated in a speech that higher tariffs would likely increase inflation, and that uncertainty had increased. This was generally interpreted as a sign that the Fed would not ride to the rescue of the economy (and the markets) at the expense of the long-fought campaign against inflation.

On April 9th, the administration announced a 90-day pause on tariffs, with the exception of China. Markets breathed a short sigh of relief, but uncertainty remained. The release of negative GDP data at month end showed the depth and breadth of the immediate impact on businesses and their outlooks and plans for 2025.

Let’s get into the data:

What Does the Data Add Up To?

Actual data releases throughout the month, including the Fed’s “Beige Book” showed that the economy was holding steady and even slightly up in some areas. This provided reassurance that the economy had entered the new era of disruption caused by tariffs with a solid foundation, but it was not enough to stave off fears that the extent and the business paralysis resulting from the uncertainty would propel the country into recession in the near term, usually interpreted to mean by the summer. Fears that the recession would begin at the Port of Los Angeles, as ships stopped arriving from China, and spread from there began to be the accepted scenario.

GDP went from a gain of 2.4% in Q4 2024 to a negative of 0.3% in the first quarter of 2025. The estimate was for a slight increase, but a massive growth in imports as businesses attempted to stock inventory before tariffs went into effect resulted in the negative, as imports are subtracted from GDP. Imports grew 41.3% in the first quarter, with most of that coming from a 50.9% increase in goods. The last time growth in imports hit this level, except for the COVID pandemic, was in 1974. This will likely reverse in the second quarter, as imports will likely drop off substantially.

However, there are other inputs that are unlikely to improve. Consumer spending is trending down, and declines in government spending, given layoffs and funding cuts, are likely to continue.

The strong labor market helps make the case that recession is not as close or as likely as feared, given the overall resiliency of the economy. The unemployment remained steady at 4.2%, and labor force participation ticked higher.

What did this look like the last time it happened? In 1974, U.S. Gross National Product was declining by 4.2% annually, inflation hit 16.8%, and unemployment was 8.9%. Despite two successive administrations attempting to fix the problem, stagflation remained throughout the 1970s. The cure was the aggressive interest rate regime of Fed Chairman Paul Volker.

The Federal Open Market Committee met during the first week of May and kept rates unchanged. In the official stated, language was added to note that “the risks of higher unemployment and higher inflation have risen. Powell noted in his speech that “despite heightened uncertainty, the economy is still in a solid position.” This would seem to indicate that the Fed will maintain the position of not making pre-emptive cuts to rates and will instead wait for the data.

The 90-day window until tariffs go into effect – or are kicked down the road again, to more uncertainty, is still running down. However, the administration unveiled the outline of an agreement with England on May 8th. It left the 10% tariff in place, which, given the “special relationship” between the U.S. and U.K., would seem to set a floor on tariffs for other countries as being no lower than 10%. Early on Monday May 12th, the U.S. and China announced an agreement to lower reciprocal tariffs for 90 days. This may push the threat of recession back substantially, even if uncertainty and volatility remain.

Chart of the Month: A Strong Labor Market Belies Recession Fears, For Now

Source: Bureau of Economic Analysis

Equity Markets in April

Source: S&P Global. All performance as of April 30, 2025.

Five of the eleven S&P 500 sectors had positive returns, with Information Technology contributing 1.58% and Energy in last place, down 13.73%. The month saw 11 of 21 trading days moving at least 1% up or down, and 8 days of at least 2% moves. Monthly intraday volatility, measured as the daily high/low, increased to 3.21% in April from March’s 1.71%.

Bond Markets in April

The 10-year U.S. Treasury ended the month at a yield of 4.18%, down from 4.22% the prior month. The 30-year U.S. Treasury ended April at 4.69%, up from 4.58%. The Bloomberg U.S. Aggregate Bond Index returned 0.39%. The Bloomberg Municipal Bond Index returned -0.81%.

The Smart Investor

Even if tariffs begin to find a floor and the trade war begins to move toward the off-ramp, volatility will likely continue given the shock to the system and the messaging from the administration. What can investors do to insulate their plans and keep their goals on track?

Stick to the tried and true. Continue to save, but as rates stay higher, consider moving saving into high-yield savings accounts, and then using dollar-cost averaging to leg into the market. While tax loss harvesting is usually a year-end rebalancing tool, there may be opportunities to take advantage throughout the year. A long-term investment strategy is built for situations like this, and there are tools and strategies that can be deployed to mitigate downturns and maximize opportunity.

The sum of your investment plan is not equal to the amount your portfolio goes up or down. Financial planning takes into account all aspects of your financial life, and many aspects of your personal life.

Combining personal goals, investments, and a view on the economy, while ensuring that all the pieces of the financial planning process are engaged, is at the core of what a financial advisor can bring to the table. We’re always here to help.

RECENT ARTICLES

May Market Commentary – Does Volatility + Uncertainty Equal Recession?

Retirement Spending and Investing: 4% Rule or U-Shaped Curve

Estate Planning: The Essential Instruments

April Market Commentary – A Shock to the System: Tariffs, Stagflation and Market Corrections

March Market Commentary – Tariffs, Inflation, and Taxes: Where’s the Balance?