The recent decision by Moody’s to downgrade America’s credit rating signals the conclusion of the nation’s premier debt standing. This move, which lowered the rating from Aaa to Aa1, follows similar actions by Fitch in 2023 and Standard & Poor’s in 2011, reflecting mounting worries about America’s fiscal path. The timing coincides with congressional discussions over a new budget proposal that may expand annual deficits, revealing the tension between reducing taxes and maintaining fiscal responsibility. Given this backdrop of debt concerns, deficit growth, and political uncertainty, investors naturally question how these developments might affect their investment strategies.

Historical budget negotiations have consistently generated market uncertainty

Over the last fifteen years, budget negotiations and debt ceiling confrontations have generated considerable market turbulence. Notable instances include Standard & Poor’s 2011 U.S. debt downgrade, the 2013 fiscal cliff, government shutdowns in 2018 and 2019, among others. Despite these challenges, resolutions were ultimately achieved in every case, enabling markets to regain stability and continue their upward trajectory.

Following the historic 2011 downgrade, which triggered a market correction, the S&P 500 achieved complete recovery in just a few months. While it appears contradictory, U.S. Treasury securities maintain their status as safe-haven investments during periods of market stress, despite these downgrades, and remain a crucial cornerstone of global financial markets.

Therefore, regarding national debt and Washington’s budgetary conflicts, maintaining proper perspective is essential. As taxpayers, voters, and citizens, concern about the nation’s unsustainable fiscal direction is understandable. Regrettably, simple solutions to these complex issues don’t exist, and numerous commissions and proposals have been unsuccessful in meaningfully reducing annual budget shortfalls.

While these concerns are substantial, avoiding excessive reactions in our investment portfolios remains crucial. Although previous fiscal difficulties and downgrades have generated uncertainty, markets have traditionally recovered and found stability over extended periods. A disciplined investment strategy emphasizing long-term objectives, diversification, and fundamental investment principles – rather than focusing on Washington news or expecting Congress to resolve deficit issues – continues to be the most effective approach for achieving long-term financial goals.

Moody’s downgrade occurs during a pivotal time as investor focus transitions from tariff discussions to Washington’s budget framework. While markets showed strong performance after last year’s presidential election, partly due to expectations of growth-oriented policies and TCJA extension, Moody’s announcement highlights the alternative aspect of the fiscal equation.

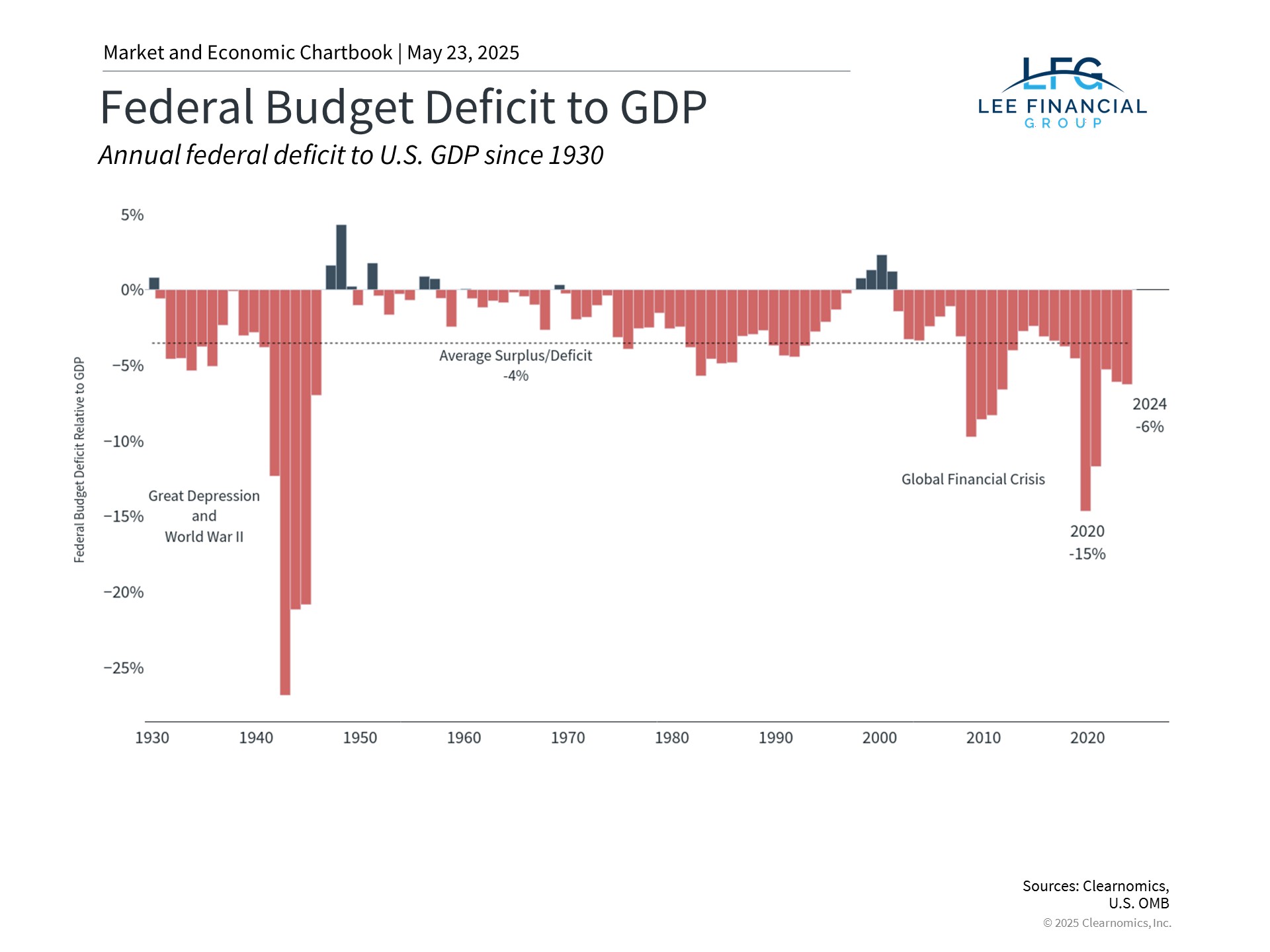

In particular, Moody’s noted that “successive US administrations and Congress have failed to agree on measures to reverse the trend of large annual fiscal deficits and growing interest costs,” and stated they “do not believe that material multi-year reductions in mandatory spending and deficits will result from current fiscal proposals under consideration.”

TCJA provisions appear likely to receive extension or permanent status

Coinciding with these developments, Congress is currently developing a new budget proposal, with certain provisions still under negotiation. The current framework seeks to establish certainty by extending TCJA individual tax reductions, which would otherwise lapse at 2025’s conclusion. This approach would prevent a potential “tax cliff” – a situation where tax rates would return to pre-TCJA levels, possibly causing economic disruption. By addressing these issues well before the expiration date, policymakers aim to deliver stability for consumers and businesses alike.

This comprehensive tax legislation encompasses multiple provisions impacting businesses and individuals. Primary components, which remain subject to modification, include:

For Individuals:

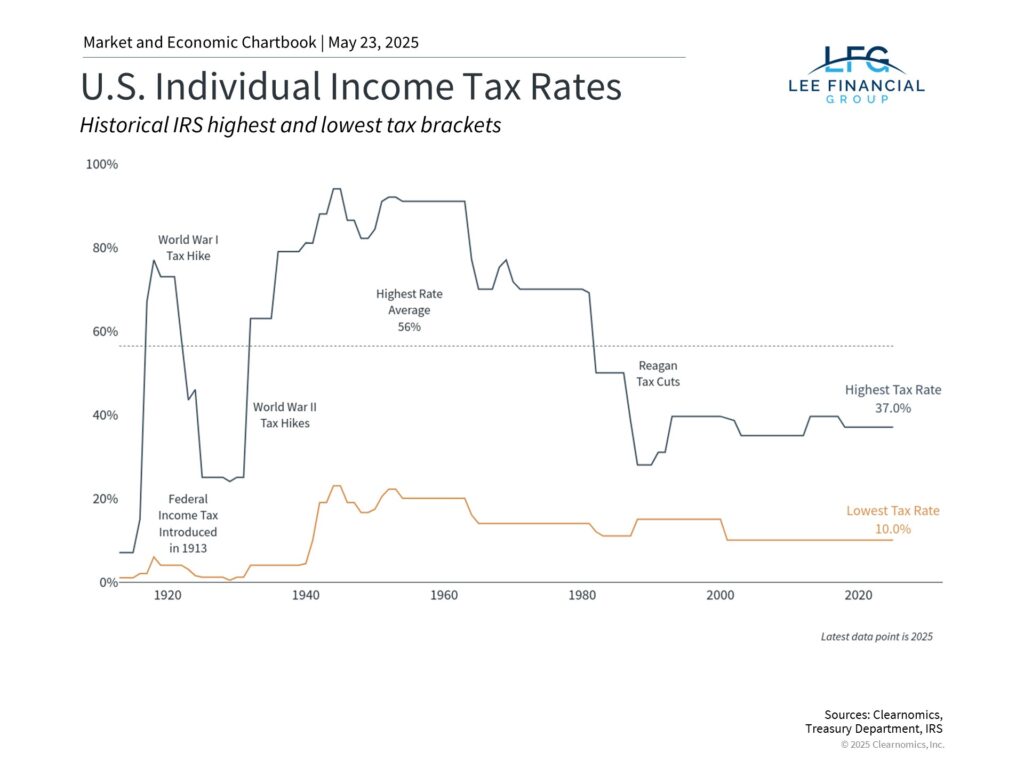

- TCJA individual tax rates would receive permanent status, maintaining a maximum rate of 37%

- Child tax credit would expand from $2,000 to $2,500 until 2028

- State and local tax (SALT) deduction limits remain contentious, with proposals for a $30,000 ceiling (up from the existing $10,000)

- Tips and overtime compensation would receive income tax exemptions through 2028

- Auto loan interest would qualify for tax deductibility through 2028

- A novel savings vehicle called the “money account for growth and advancement” (termed “MAGA accounts”) would be established for children under 8 for educational purposes, small business investments, and initial home purchases

For Businesses:

- Pass-through business deduction would expand from 20% to 23% with permanent status

- Complete bonus depreciation for qualifying business assets would resume for property obtained from January 2025 through 2029

- Research and development tax deductions would be restored

The proposal notably excludes provisions for a “millionaire tax” and modifications to carried interest taxation, which some had expected. The debt ceiling, representing the nation’s borrowing capacity, might also increase by $4 trillion.

Continuing deficits may further increase total debt burden

Although the current proposal incorporates roughly $1.6 trillion in spending cuts through modifications to programs including Medicaid and nutritional assistance, these reductions are exceeded by tax decreases and spending increases elsewhere.

Annual budget shortfalls are significant because they contribute to national debt, which has surpassed $36 trillion, representing approximately $106,000 per American. Reports indicate the proposed budget may add an estimated $3 trillion or more to debt over the coming decade. The latest assessment from the Joint Committee on Taxation, Congress’s nonpartisan committee, indicated debt could rise by $3.7 trillion during this timeframe.

National debt growth over recent decades is well-documented, with interest payments steadily increasing. Since most federal expenditures support mandatory programs including Social Security and Medicare, reaching consensus on substantial spending reductions proves politically challenging. This reality leads some to worry that tax rates may eventually require increases to bridge the gap, despite near-term TCJA extension or permanent adoption.

While deficit and debt levels represent important factors for long-term economic health, their immediate effects should be viewed proportionately. Markets have traditionally delivered strong performance across different levels of government debt and deficit spending. Paradoxically, some of the most robust market gains over the past two decades have followed the largest deficits, as these typically occurred during economic crises when markets reached bottom levels. Therefore, basing investment decisions on government spending and deficits would have proven counterproductive.

The bottom line? America’s credit rating downgrade emphasizes worries about the nation’s long-term fiscal direction. Current budget negotiations may compound these challenges. However, historical evidence indicates that investors can best navigate these difficulties by remaining invested and adhering to long-term financial strategies.

Understanding the Investment Implications of Rising Debt and Credit Downgrades

Understanding the Investment Implications of Rising Debt and Credit Downgrades

The recent decision by Moody’s to downgrade America’s credit rating signals the conclusion of the nation’s premier debt standing. This move, which lowered the rating from Aaa to Aa1, follows similar actions by Fitch in 2023 and Standard & Poor’s in 2011, reflecting mounting worries about America’s fiscal path. The timing coincides with congressional discussions over a new budget proposal that may expand annual deficits, revealing the tension between reducing taxes and maintaining fiscal responsibility. Given this backdrop of debt concerns, deficit growth, and political uncertainty, investors naturally question how these developments might affect their investment strategies.

Historical budget negotiations have consistently generated market uncertainty

Over the last fifteen years, budget negotiations and debt ceiling confrontations have generated considerable market turbulence. Notable instances include Standard & Poor’s 2011 U.S. debt downgrade, the 2013 fiscal cliff, government shutdowns in 2018 and 2019, among others. Despite these challenges, resolutions were ultimately achieved in every case, enabling markets to regain stability and continue their upward trajectory.

Following the historic 2011 downgrade, which triggered a market correction, the S&P 500 achieved complete recovery in just a few months. While it appears contradictory, U.S. Treasury securities maintain their status as safe-haven investments during periods of market stress, despite these downgrades, and remain a crucial cornerstone of global financial markets.

Therefore, regarding national debt and Washington’s budgetary conflicts, maintaining proper perspective is essential. As taxpayers, voters, and citizens, concern about the nation’s unsustainable fiscal direction is understandable. Regrettably, simple solutions to these complex issues don’t exist, and numerous commissions and proposals have been unsuccessful in meaningfully reducing annual budget shortfalls.

While these concerns are substantial, avoiding excessive reactions in our investment portfolios remains crucial. Although previous fiscal difficulties and downgrades have generated uncertainty, markets have traditionally recovered and found stability over extended periods. A disciplined investment strategy emphasizing long-term objectives, diversification, and fundamental investment principles – rather than focusing on Washington news or expecting Congress to resolve deficit issues – continues to be the most effective approach for achieving long-term financial goals.

Moody’s downgrade occurs during a pivotal time as investor focus transitions from tariff discussions to Washington’s budget framework. While markets showed strong performance after last year’s presidential election, partly due to expectations of growth-oriented policies and TCJA extension, Moody’s announcement highlights the alternative aspect of the fiscal equation.

In particular, Moody’s noted that “successive US administrations and Congress have failed to agree on measures to reverse the trend of large annual fiscal deficits and growing interest costs,” and stated they “do not believe that material multi-year reductions in mandatory spending and deficits will result from current fiscal proposals under consideration.”

TCJA provisions appear likely to receive extension or permanent status

Coinciding with these developments, Congress is currently developing a new budget proposal, with certain provisions still under negotiation. The current framework seeks to establish certainty by extending TCJA individual tax reductions, which would otherwise lapse at 2025’s conclusion. This approach would prevent a potential “tax cliff” – a situation where tax rates would return to pre-TCJA levels, possibly causing economic disruption. By addressing these issues well before the expiration date, policymakers aim to deliver stability for consumers and businesses alike.

This comprehensive tax legislation encompasses multiple provisions impacting businesses and individuals. Primary components, which remain subject to modification, include:

For Individuals:

For Businesses:

The proposal notably excludes provisions for a “millionaire tax” and modifications to carried interest taxation, which some had expected. The debt ceiling, representing the nation’s borrowing capacity, might also increase by $4 trillion.

Continuing deficits may further increase total debt burden

Although the current proposal incorporates roughly $1.6 trillion in spending cuts through modifications to programs including Medicaid and nutritional assistance, these reductions are exceeded by tax decreases and spending increases elsewhere.

Annual budget shortfalls are significant because they contribute to national debt, which has surpassed $36 trillion, representing approximately $106,000 per American. Reports indicate the proposed budget may add an estimated $3 trillion or more to debt over the coming decade. The latest assessment from the Joint Committee on Taxation, Congress’s nonpartisan committee, indicated debt could rise by $3.7 trillion during this timeframe.

National debt growth over recent decades is well-documented, with interest payments steadily increasing. Since most federal expenditures support mandatory programs including Social Security and Medicare, reaching consensus on substantial spending reductions proves politically challenging. This reality leads some to worry that tax rates may eventually require increases to bridge the gap, despite near-term TCJA extension or permanent adoption.

While deficit and debt levels represent important factors for long-term economic health, their immediate effects should be viewed proportionately. Markets have traditionally delivered strong performance across different levels of government debt and deficit spending. Paradoxically, some of the most robust market gains over the past two decades have followed the largest deficits, as these typically occurred during economic crises when markets reached bottom levels. Therefore, basing investment decisions on government spending and deficits would have proven counterproductive.

The bottom line? America’s credit rating downgrade emphasizes worries about the nation’s long-term fiscal direction. Current budget negotiations may compound these challenges. However, historical evidence indicates that investors can best navigate these difficulties by remaining invested and adhering to long-term financial strategies.

RECENT ARTICLES

Understanding the Investment Implications of Rising Debt and Credit Downgrades

Financial Planning For Starting a Family

May Market Commentary – Does Volatility + Uncertainty Equal Recession?

Retirement Spending and Investing: 4% Rule or U-Shaped Curve

Estate Planning: The Essential Instruments