Many Americans think of the U.S. dollar as a symbol of our country’s strength around the world. But lately, the dollar has gotten weaker compared to other major currencies. It has dropped to its lowest point in three years. This has made some people worry that the dollar might lose its important role in the global economy.

If you’re an investor, it’s helpful to understand how the dollar works in world markets. Knowing what makes the dollar stronger or weaker can help you make better decisions about your investments. Let’s look at what’s causing these recent changes and what they might mean for the future.

The dollar’s role in history

The U.S. dollar has been the world’s main reserve currency for about 100 years. A reserve currency is the money that countries and banks around the world prefer to hold and use for international business. The dollar took over this role from the British pound after World War I. Some people worry that things like politics, our national debt, trade rules, or new alternatives like China’s currency or digital currencies might threaten this special status.

But these worries aren’t new. They come up every time there’s economic uncertainty. In the 1980s, people thought Japan’s strong economy might make the yen more important than the dollar. When Europe created the euro in the 2000s, and as China’s economy grew, people made similar predictions. More recently, the rise of digital currencies has raised questions about whether traditional money like the dollar will stay important.

Even with these concerns, the dollar has kept its central role through many economic ups and downs. This happens because U.S. financial markets are deep and easy to trade in, American institutions are relatively stable, and the dollar is still widely used in international trade and investing. During global economic crises, people still see the dollar as a safe place to put their money.

In our daily lives, we usually think a strong dollar is always good. When the dollar is strong, it’s cheaper to travel to other countries and buy imported goods. This can help keep prices down for consumers.

But a strong dollar also has downsides, especially for selling our products to other countries. When the dollar is strong, American products become more expensive for people in other countries to buy. This can hurt U.S. manufacturers and farmers who sell their goods overseas. This is why some countries try to keep their currencies weak on purpose – it makes their exports cheaper and more attractive to foreign buyers.

The best currency level isn’t about being the strongest or weakest – it’s about finding the right balance.

What makes the dollar’s value change

Countries handle their currencies in different ways. Some, like the United States and United Kingdom, let their currencies “float freely.” This means the market decides what the currency is worth based on supply and demand. Other countries fix their currency’s value by tying it to another major currency like the dollar or euro. This requires their central bank (like our Federal Reserve) to step in and buy or sell currency to maintain that fixed rate, which can be difficult to keep up.

One big factor that affects currency values is international trade. When people from other countries buy American goods and services, they first need to exchange their money for dollars. This creates demand for dollars, which pushes up the dollar’s value. The opposite happens when Americans buy more from other countries than we sell to them – dollars get sold for foreign currencies, which can weaken the dollar.

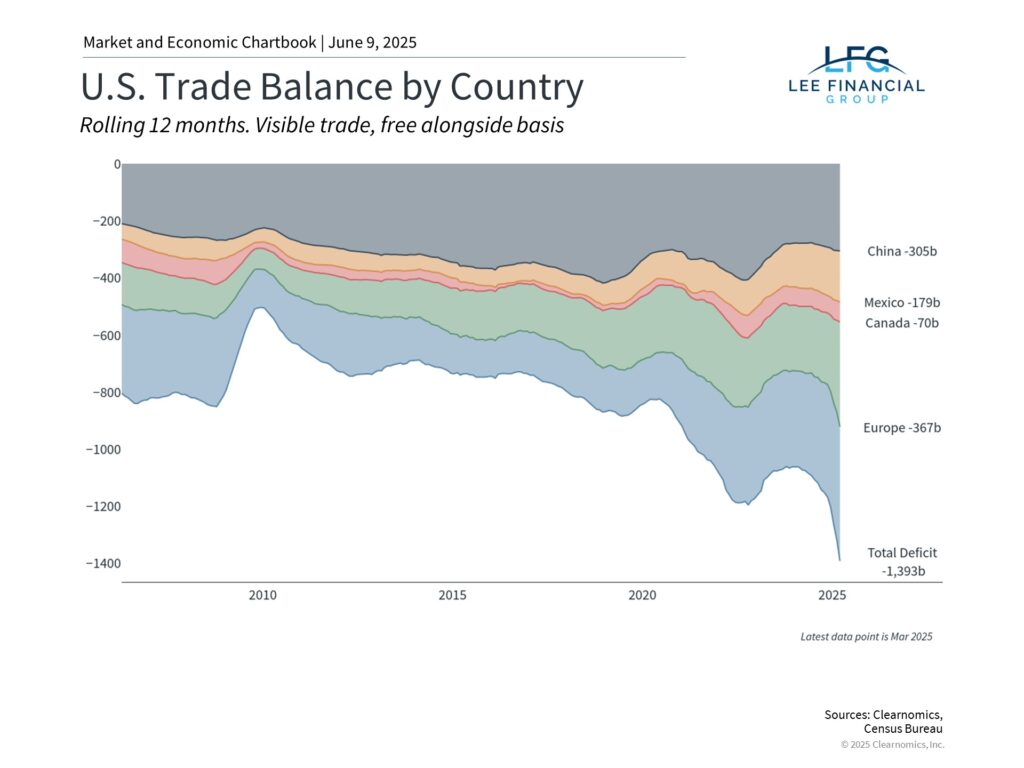

This is why having a trade deficit (importing more than we export) usually makes a currency weaker. Over the past year, the U.S. imported $1 trillion more than it exported, as shown in the chart. This trade imbalance has continued for many years, partly because central banks and foreign businesses around the world want to hold dollars.

Interestingly, recent tariffs (fees on imported goods) haven’t made the dollar stronger. Economic theory suggests that U.S. tariffs on foreign goods should reduce imports, which would increase demand for dollars. However, many companies bought extra foreign goods before the tariffs took effect. Plus, other factors like money flows and political uncertainty also affect the currency.

Trade is just one piece of the currency puzzle. Money flows between countries, interest rates, central bank policies, and international lending all contribute to how much demand there is for dollars worldwide. Because these factors are so complex, currency movements often don’t match simple economic indicators.

For example, differences in interest rates are very important for currency values. When the Federal Reserve sets interest rates higher than other major central banks, it usually creates demand for dollars. This happens because investors might move their money to higher-paying U.S. Treasury bonds. In financial markets, this strategy is called a “carry trade.”

Concerns about government spending might also be affecting the dollar. With national debt approaching 120% of GDP (gross domestic product – the total value of goods and services produced in the country) and ongoing budget deficits, some investors worry about whether U.S. fiscal policy (government spending and taxation) is sustainable long-term. While these concerns haven’t reached crisis levels, they add another layer of complexity to valuing the dollar.

The dollar keeps its global importance

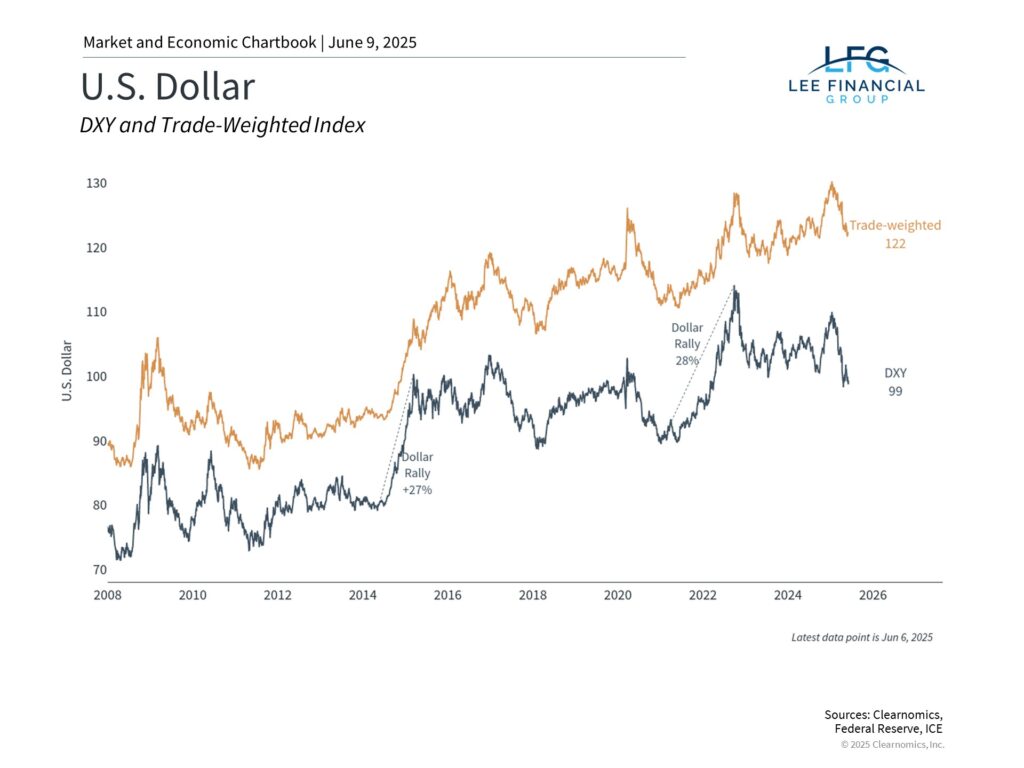

With so many factors affecting the dollar’s value, we need perspective when looking at current levels. While the dollar has fallen to its lowest point in three years, looking at a longer time frame shows these levels are still near their strongest over the past twenty years. As always, it’s important to keep a broad view and not overreact to recent changes.

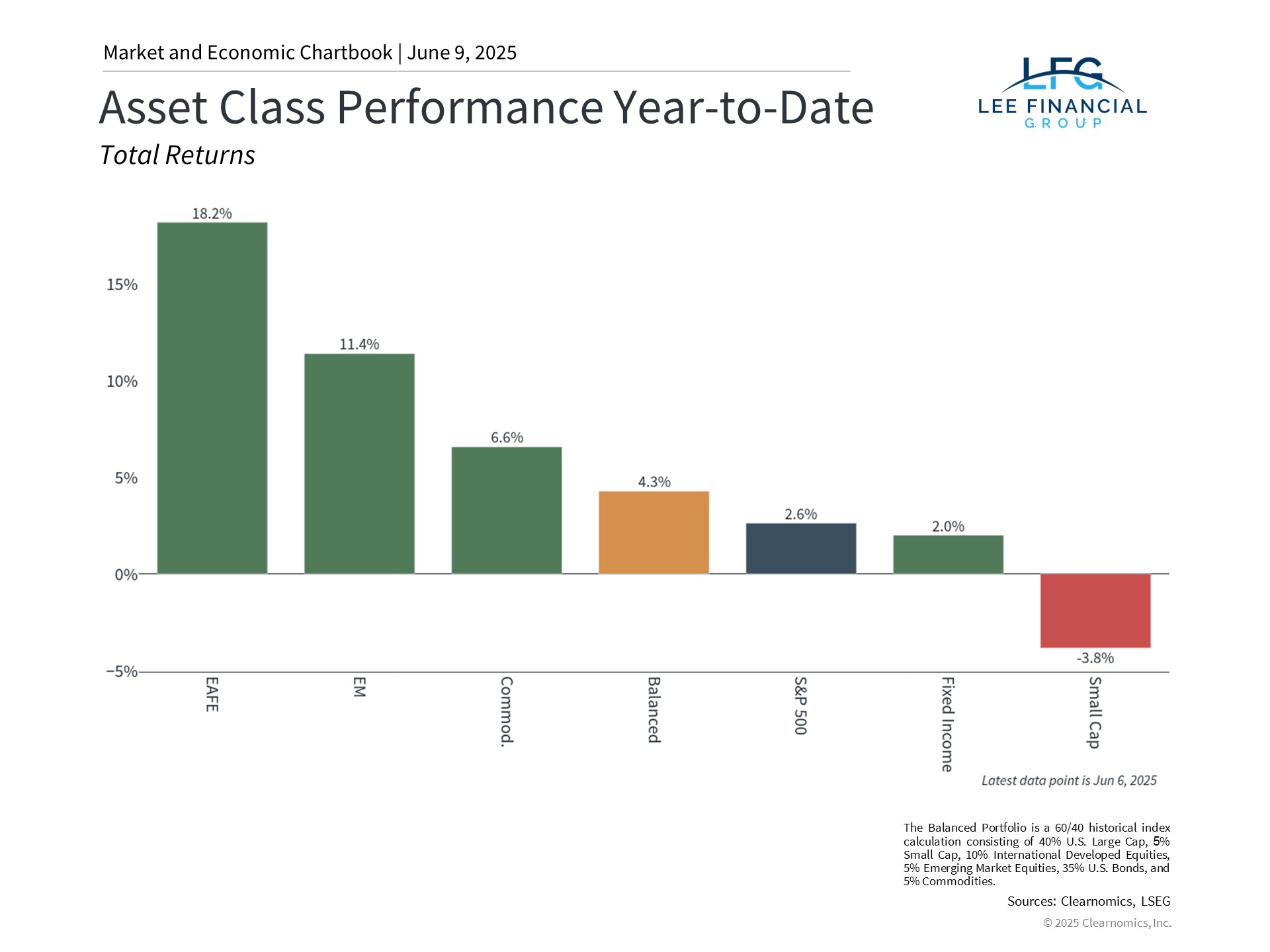

For investors, a somewhat weaker dollar has actually been helpful this year for diversified portfolios (investment collections that include different types of assets). When the dollar falls, international investments are worth more when converted back to dollars, boosting returns. The chart shows that the MSCI EAFE index (which tracks developed market stocks outside the U.S.) and the MSCI EM index (which tracks emerging market stocks) have performed better than the S&P 500 this year.

The bottom line?

Despite legitimate concerns, the dollar continues to serve as the world’s main reserve currency. More importantly for investors, it has helped boost diversified portfolios this year. Investors should keep a long-term view when thinking about the dollar.

What a Weaker Dollar Means for Your Investments

What a Weaker Dollar Means for Your Investments

Many Americans think of the U.S. dollar as a symbol of our country’s strength around the world. But lately, the dollar has gotten weaker compared to other major currencies. It has dropped to its lowest point in three years. This has made some people worry that the dollar might lose its important role in the global economy.

If you’re an investor, it’s helpful to understand how the dollar works in world markets. Knowing what makes the dollar stronger or weaker can help you make better decisions about your investments. Let’s look at what’s causing these recent changes and what they might mean for the future.

The dollar’s role in history

The U.S. dollar has been the world’s main reserve currency for about 100 years. A reserve currency is the money that countries and banks around the world prefer to hold and use for international business. The dollar took over this role from the British pound after World War I. Some people worry that things like politics, our national debt, trade rules, or new alternatives like China’s currency or digital currencies might threaten this special status.

But these worries aren’t new. They come up every time there’s economic uncertainty. In the 1980s, people thought Japan’s strong economy might make the yen more important than the dollar. When Europe created the euro in the 2000s, and as China’s economy grew, people made similar predictions. More recently, the rise of digital currencies has raised questions about whether traditional money like the dollar will stay important.

Even with these concerns, the dollar has kept its central role through many economic ups and downs. This happens because U.S. financial markets are deep and easy to trade in, American institutions are relatively stable, and the dollar is still widely used in international trade and investing. During global economic crises, people still see the dollar as a safe place to put their money.

In our daily lives, we usually think a strong dollar is always good. When the dollar is strong, it’s cheaper to travel to other countries and buy imported goods. This can help keep prices down for consumers.

But a strong dollar also has downsides, especially for selling our products to other countries. When the dollar is strong, American products become more expensive for people in other countries to buy. This can hurt U.S. manufacturers and farmers who sell their goods overseas. This is why some countries try to keep their currencies weak on purpose – it makes their exports cheaper and more attractive to foreign buyers.

The best currency level isn’t about being the strongest or weakest – it’s about finding the right balance.

What makes the dollar’s value change

Countries handle their currencies in different ways. Some, like the United States and United Kingdom, let their currencies “float freely.” This means the market decides what the currency is worth based on supply and demand. Other countries fix their currency’s value by tying it to another major currency like the dollar or euro. This requires their central bank (like our Federal Reserve) to step in and buy or sell currency to maintain that fixed rate, which can be difficult to keep up.

One big factor that affects currency values is international trade. When people from other countries buy American goods and services, they first need to exchange their money for dollars. This creates demand for dollars, which pushes up the dollar’s value. The opposite happens when Americans buy more from other countries than we sell to them – dollars get sold for foreign currencies, which can weaken the dollar.

This is why having a trade deficit (importing more than we export) usually makes a currency weaker. Over the past year, the U.S. imported $1 trillion more than it exported, as shown in the chart. This trade imbalance has continued for many years, partly because central banks and foreign businesses around the world want to hold dollars.

Interestingly, recent tariffs (fees on imported goods) haven’t made the dollar stronger. Economic theory suggests that U.S. tariffs on foreign goods should reduce imports, which would increase demand for dollars. However, many companies bought extra foreign goods before the tariffs took effect. Plus, other factors like money flows and political uncertainty also affect the currency.

Trade is just one piece of the currency puzzle. Money flows between countries, interest rates, central bank policies, and international lending all contribute to how much demand there is for dollars worldwide. Because these factors are so complex, currency movements often don’t match simple economic indicators.

For example, differences in interest rates are very important for currency values. When the Federal Reserve sets interest rates higher than other major central banks, it usually creates demand for dollars. This happens because investors might move their money to higher-paying U.S. Treasury bonds. In financial markets, this strategy is called a “carry trade.”

Concerns about government spending might also be affecting the dollar. With national debt approaching 120% of GDP (gross domestic product – the total value of goods and services produced in the country) and ongoing budget deficits, some investors worry about whether U.S. fiscal policy (government spending and taxation) is sustainable long-term. While these concerns haven’t reached crisis levels, they add another layer of complexity to valuing the dollar.

The dollar keeps its global importance

With so many factors affecting the dollar’s value, we need perspective when looking at current levels. While the dollar has fallen to its lowest point in three years, looking at a longer time frame shows these levels are still near their strongest over the past twenty years. As always, it’s important to keep a broad view and not overreact to recent changes.

For investors, a somewhat weaker dollar has actually been helpful this year for diversified portfolios (investment collections that include different types of assets). When the dollar falls, international investments are worth more when converted back to dollars, boosting returns. The chart shows that the MSCI EAFE index (which tracks developed market stocks outside the U.S.) and the MSCI EM index (which tracks emerging market stocks) have performed better than the S&P 500 this year.

The bottom line?

Despite legitimate concerns, the dollar continues to serve as the world’s main reserve currency. More importantly for investors, it has helped boost diversified portfolios this year. Investors should keep a long-term view when thinking about the dollar.

RECENT ARTICLES

Deferred Compensation – A Plan for Unlimited Retirement Savings

What a Weaker Dollar Means for Your Investments

June Market Commentary – The Limits of Data in an Ever-Changing Environment

Expanding Portfolio Horizons: Exploring Diversification Opportunities Beyond Major Indices

Understanding the Investment Implications of Rising Debt and Credit Downgrades