Equities serve as fundamental building blocks for long-term investment portfolios. When integrated into a well-structured financial strategy, equity investments have traditionally generated wealth and supported investors in reaching their financial objectives. Yet an important consideration emerges: which types of equities should be included? While market participants and financial media often concentrate on the largest corporations, numerous other categories can serve vital functions within diversified investment portfolios.

Market discussions frequently center around the S&P 500 or Dow Jones Industrial Average as proxies for the entire equity market. The S&P 500 represents an index monitoring the performance of 500 of the largest publicly traded corporations, ranked by market capitalization as a company size metric. The Dow encompasses just 30 large, established enterprises. Both indices predominantly feature companies that are incorporated and based in the United States.

Given their construction methodology, these benchmarks concentrate exclusively on America’s largest corporations. This approach proves valuable for gauging overall market conditions and economic trends, as the biggest companies typically drive these movements. Nevertheless, when constructing investment portfolios, these indices might miss other promising opportunities. This consideration becomes particularly significant when a select group of “mega cap” stocks, including members of the Magnificent 7, have been the main catalysts behind both gains and losses.

Given this market landscape, how might investors expand their investment outlook? Small-capitalization stocks and global markets represent two examples of sectors that can deliver opportunities and diversification benefits. Both offer unique characteristics and potential advantages that can strengthen portfolio diversification, particularly during periods of market turbulence and economic uncertainty.

Small-cap equities have underperformed but provide diversification advantages

Small-capitalization stocks encompass companies with market values typically spanning from several hundred million to a few billion dollars. This differs significantly from mid and large-cap enterprises that range from tens to hundreds of billions, and mega cap companies now valued in the trillions.

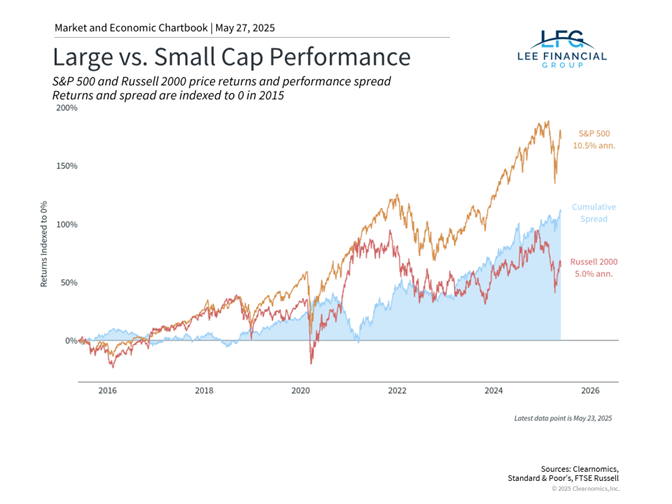

The Russell 2000 index, which measures small-cap performance, has delivered 5.0% annualized returns during the past decade versus 10.5% for the S&P 500, as illustrated in the corresponding chart.1

This performance disparity has been especially notable in recent years as market concentration among large and mega cap companies has grown, particularly within technology and artificial intelligence-focused sectors. Small-cap enterprises generally maintain lower technology sector exposure and generate more revenue from domestic activities, creating sensitivity to shifts in U.S. economic policies and trade relationships.

Remarkably, small caps have faced challenges year-to-date amid persistent uncertainty regarding tariffs and economic expansion. Nevertheless, this situation has produced potentially appealing valuations. Small-cap securities currently trade at more reasonable price-to-earnings multiples relative to large-cap stocks. The Russell 2000 presently exhibits a price-to-earnings ratio significantly below its 10-year average. Even more notable is the price-to-book value of approximately 0.8x, substantially lower than the historical average of 1.2x. By contrast, many S&P 500 valuation measures are well above average, approaching all-time peaks in some cases.

The interest rate landscape presents another significant distinction between large and small-cap companies. Small caps frequently depend more extensively on floating rate debt financing compared to their large-cap peers, creating greater sensitivity to interest rate movements. Although this posed difficulties when rates climbed rapidly starting in 2022, the current more stable environment could provide support. This becomes especially relevant if the Fed proceeds with additional rate reductions this year.

Many of these indicators suggest that small-cap stocks present more attractive valuations than numerous other market segments. While large caps will maintain their significance in many portfolios, this underscores that opportunities exist throughout various market areas.

Global markets remain attractively priced

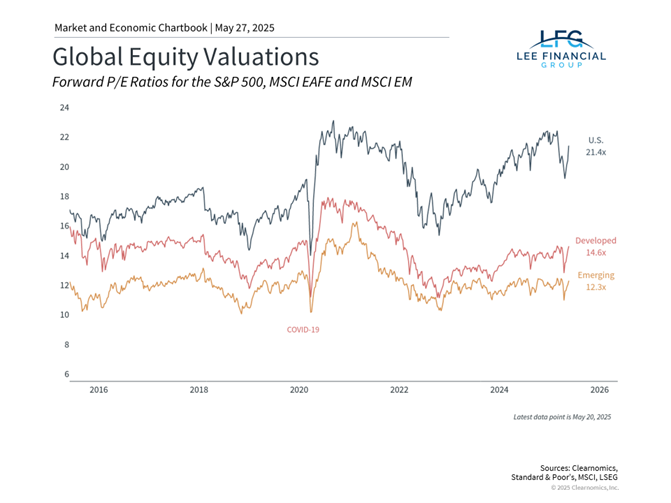

Another sector offering compelling valuations is international equities, commonly divided into two primary categories: developed markets (including Europe, Japan, and Australia) and emerging markets (encompassing nations like China, India, and Brazil). These distinctions represent differences in economic development, market structure, regulatory environments, and additional factors.

Despite U.S. equities leading global markets throughout much of the previous decade, international stocks have outperformed this year. The MSCI EAFE index, which monitors 21 major developed market nations, has advanced approximately 17.5% year-to-date in U.S. dollar terms. The MSCI EM index, tracking emerging markets, has increased 10%.2

These gains have materialized despite global uncertainty stemming from trade considerations.

Beyond superior performance this year, valuation disparities remain considerable. While the S&P 500 trades at elevated price-to-earnings multiples, international markets present more compelling valuations, as demonstrated in the chart above. This partly reflects political and economic obstacles in many regions over the past decade, some of which have started improving.

A crucial distinction between U.S. and international investing involves currency fluctuation impacts on returns. The weaker dollar has established favorable circumstances for U.S.-based investors. Foreign assets appreciate when their denominated currencies strengthen, enabling conversion back to additional dollars. This currency benefit has meaningfully contributed to international stocks’ robust performance this year, providing extra support beyond the fundamental performance of foreign enterprises.

Diversification across regions and market capitalizations remains crucial

For long-term investors, preserving exposure to areas including small-cap and international equities can help construct more balanced portfolios. This proves particularly relevant following the substantial performance of large-cap stocks driven by merely a handful of the largest companies.

This perspective doesn’t suggest U.S. large caps will diminish in importance. This also doesn’t advocate for major modifications to well-designed portfolios. Rather, maintaining long-term portfolios involves holding appropriate asset allocation across all these investment types. By incorporating more attractively valued market segments, we can potentially enhance long-term risk-adjusted results and capitalize on market opportunities. While individual asset classes may underperform during specific periods, their varying characteristics and return behaviors can deliver valuable diversification benefits over time.

The bottom line? Although the S&P 500 and Dow remain significant benchmarks, investors should evaluate the advantages of diversifying across numerous other market segments, including smaller enterprises and international equities. Maintaining suitable portfolios for the long term continues to be the optimal approach for achieving financial success.

1 Russell 2000 and S&P 500, price returns, from January 2, 2015 to May 23, 2025

2 MSCI EAFE and MSCI EM, total returns, January 1, 2025 to May 23, 2025

What a Weaker Dollar Means for Your Investments