The Federal Reserve has succeeded in bringing inflation down to the long-term goal rate of near 2%, which is good news for consumers. But for savers and taxpayers, this means that the big increases we’ve seen in recent years that have been pegged to inflation are now a thing of the past. The IRS pegs tax brackets, tax deductions, 401(k), and other tax-efficient vehicle contribution amounts to inflation. It utilizes a formula based on the Consumer Price Index to account for the impact of inflation and determine the changes, and with inflation hitting its lowest point in three years, it’s to be expected that the changes this year aren’t significant.

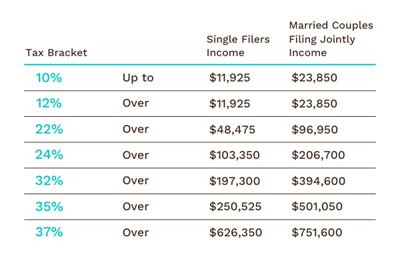

The new inflation-adjusted tax brackets for 2025 see income thresholds rising a mere 2.8% from 2024.

However, it’s important to note the new brackets and make adjustments where necessary. Good tax planning looks to save you money over your entire life, so keeping tax brackets in mind and making potential adjustments to charitable giving and tax-advantaged savings contributions can help you minimize your tax bill. Saving the maximum in your 401(k) or other tax-efficient savings account lowers your taxes A careful review of your financial picture, combined with some proactive tax planning, may save you money and set you up for increased savings growth in the years to come.

Tax Brackets Increases Are Minimal

Inflation means credits, deductions, and exemptions are worth less, which translates to an increase in taxes paid. The IRS wants to be sure that the tax brackets reflect people’s real income, so by pegging them to inflation the brackets can keep pace. The idea is to protect taxpayers, by raising the income range in each bracket to shelter more income from higher rates. The amount of the increase is usually so small that it doesn’t affect most people’s tax brackets.

The Standard Deduction Is Increasing

The standard deduction – the amount you are entitled to claim without itemizing – increased to $15,000 for single files in 2025. For married couples filing jointly, the new deduction amount is $30,000. If you don’t usually itemize, this is probably good news. However, if you do itemize, you may find that some of your regular deductions, such as gifts to charity, are no longer tax benefits if the amount doesn’t get you above the standard deduction.

One solution is to bunch your charitable gifts. “Bunching” refers to grouping donations intended for several years into a single year. This strategy is only effective if all your itemized deductions, including the bunched gifts, are more than the standard deduction.

Retirement and Healthcare Savings Contributions Got A Boost

Retirement savings contributions are increasing in 2025. The new maximum contribution limit is $23,500. The new limit doesn’t just mean increased savings; it also lowers your taxable income. The “catch-up” limit for people 50+ will remain at $7,500. But for people aged 60 to 63, beginning in 2025 the catch-up contribution limit is $11,250. This new limit will be adjusted for inflation beginning in 2026.

Flexible health spending accounts got a $100 boost, allowing you to contribute $3,300 of pre-tax dollars to this type of account to pay for medical costs that aren’t covered by insurance.

The maximum carry over amount is $660 for plan years beginning in 2025.

Health Savings Accounts (HSAs) have new maximum contributions, too. An individual can contribute up to $4,300, and the family contribution has risen to $8,550. These accounts are referred to as “triple-tax-advantaged” because you contribute pre-tax dollars that lower your taxable income in the year you contribute, the accounts grow tax-free, and qualified withdrawals are also not taxed.

Social Security Taxes

Social security benefits increased as well, which may be good news for retirees. However, if you’re still working, you’re still paying into the system. Social security taxes are 6.2% of income, up to a maximum earnings ceiling. The limit increased to $176,100 in 2025, from 168,600 in 2024. This translates to a dollar amount of $10,918.20.

What Remains

Not all provisions are adjusted annually for inflation, some remain unchanged for the year 2025:

- The SALT deduction cap of $10,000

- The Child Tax Credit of $2,000, with a refundable amount of $1,700

- The Lifetime Learning Credit, 20% of up to $10,000, a maximum

The Bottom Line

Making small adjustments to your financial planning to stay current can help you stay on track with savings goals and minimizing taxes. Taking advantage of every avenue you have, from increasing your max contribution to enacting multi-year tax strategies is a great way to help you build wealth.

What a Weaker Dollar Means for Your Investments