December Recap and January Outlook

The drama around the timing of the Federal Reserve’s first cuts to the key short-term interest rate continued in last few weeks of the old year and into the first week of the new year.

Two months of slowing labor market data, coupled with a change to the wording in the December FOMC statement that seemed to indicate the Fed is done tightening interest rates had futures markets pricing in an almost 80% chance of a rate cut at the March meeting.

And then December non-farm payrolls boomed past estimates and the Board of Labor’s report showed that wages are again outpacing inflation.

Are rates still likely to come down in 2024? The Fed’s dot plot, also from the final meeting in 2023, showed a projected 2.5% interest rate cut by year end 2026, with the median position projecting a 75 basis point decrease in 2024, a further 100 basis points in 2025, and the final 75 basis points in 2026.

The prospect of cutting interest rates while the economy is still growing, even if more slowly, would mean that the unicorn “soft landing” has been reached. Inflation has come down, but despite displaying more confidence that the already enacted rate cuts are doing the intended work, Powell left the door open by describing the “last mile” of getting inflation back to 2% as more difficult, since the supply side of the equation has normalized and moderating demand is now even more important.

Let’s get into the data:

- Labor markets rebounded in December. Non-farm payrolls increased by 216,000 according to the Bureau of Labor Statistics, well over consensus expectations for a gain of 170,000. Wages also beat expectations, rising 4.1% compared to a year ago.

- Retail sales moderated. Mastercard data shows holiday sales between November 1 and December 24 grew at a 3.1% pace, after gaining 7.6% last year.

- Shelter inflation continued a downward trend. Housing costs have skyrocketed since 2020, accounting for almost 70% of the 4% increase in core CPI seen in November. But they’ve been dropping since March, and reached an annual rate of 6.5% in November.

What Does the Data Add Up To?

After a nine-week positive streak largely fueled by growing confidence that the end of the rate-tightening regime was near, and the new year would bring a rapid series of rate cuts, equity markets came down to earth a little bit as the month began. Expectations of a March rate cut may have been unrealistic, but pushing cuts out further into the year still seems to be on the table.

Ensuring that inflation continues to descend to the 2% realm is the Fed’s priority, and one factor that has dogged Powell in that fight is the perception of consumers of the likely path and timing of inflation. Powell’s fear has been sticky, entrenched inflation that doesn’t respond to policy. With housing costs finally seeing some relief, and prices beginning to deflate, consumers are finally starting to have a different view.

The Federal Reserve Bank of New York’s Survey of Consumer Expectations, which was released on January 8th, shows that inflation expectations for one year from now declined to the lowest level since January 2021. Consumers now think inflation will be at 3% by next January. Consumer views on inflation are an important factor in policy determination, because inflation can be a self-fulfilling prophecy. If consumers think inflation will continue to rise, they purchase more now in the belief that things will cost more later. An expectation of falling inflation can lead to consumers postponing purchases, which can help organically slow the economy.

In the best-case scenario for the end of 2024, according to the Fed’s projections, PCE inflation hits 2.4% (still high) interest rates fall to 4.25%-4.50% (still higher) and unemployment rises to a little over 4%. The economy will slow, but still grow, and if there is a recession, it will be mild.

The wild cards? A domestic election year, gas prices that are vulnerable to increasing geopolitical tensions, and the potential that the massive increases in interest rates have more of an impact on the economy than what we’ve seen so far. We’re already seeing this in the housing market, as higher mortgage rates have slowed sales.

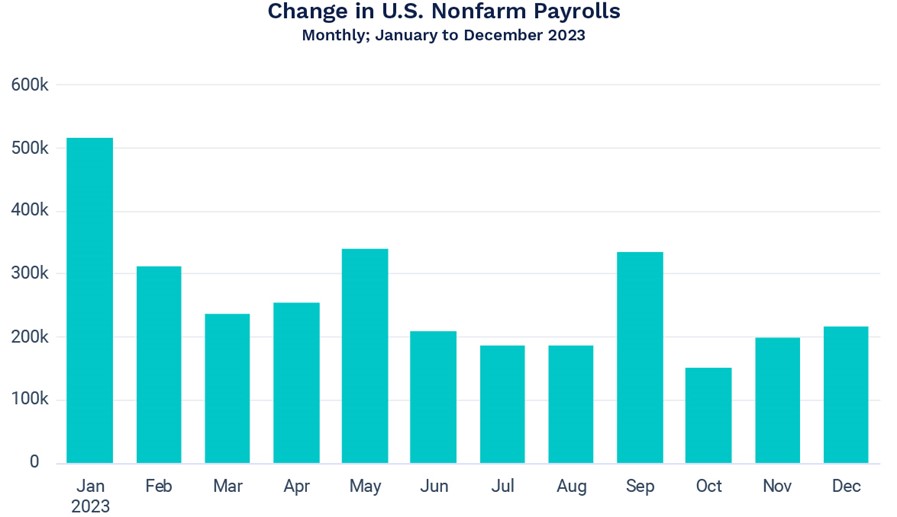

Chart of the Month: Labor Outstrips Expectations

After two months of moderating job gains, December was outstripped expectations. However, the impact of the gain on investors’ expectations for a rate cut in March may be more significant than the message for the labor markets. The last two month’s number were revised down a bit, and the total average monthly payroll employment increase was 225,000 in 2023, compared to 399,000 in 2022.

Source: U.S. Department of Labor data, unrevised. Chart: Axios Visuals

Equity Markets in December

The S&P 500 was up 4.42% for the month and ended the year up 24.32%

- The Dow Jones Industrial Average rose 4.84% for a 2023 return of 13.70%

- The S&P Mid-Cap 400 increased 8.50% in December and 14.45% in 2023

- The S&P Small-Cap 600 was up 12.61% in December and ended the year up 13.89%

Source: S&P Global. All performance as of December 31, 2023

Equity markets closed out the year with enough positive performance to wipe the double-digit losses in 2022 off the slate. At the sector level, there were still winners and losers, with Information Technology out in front with a return over the two-year period (2022 and 2023) of 11.18%. Despite a loss of 4.80% in 2023, Energy has return to burn over the two-year period, up 51.41%. Utilities were the biggest loser, down 11.49% in the combined period.

Bond Markets

The 10-year U.S. Treasury ended the month at a yield of 3.88%, down from 4.34% the prior month. The 30-year U.S. Treasury ended December at 4.04%, down from 4.50%. The Bloomberg U.S. Aggregate Bond Index returned 3.83%, pushing the year-to-date return 5.15%.

The Smart Investor

This time of year, good intentions, new goals, and lots of buying organization aids are at the top of everyone’s lists. While buying boxes to store your holiday decorations, or a new planner, or any of the myriad options to organize your life, your time and your stuff are all good ideas, getting your financial life renovated or at least tidied up will keep you on track with everything else you want to make happen in 2024.

There’s a lot to do, but don’t try to do it all at once. Think about your financial plan along with your life goals, and tackle things as they come up.

- Will you receive a financial bonus in 2024? Will you invest it, pay down debt, or use it to achieve another goal? Earmarking funds in advance can help you ensure that the money goes where you want it, and doesn’t get dissipated by short-term goals or wants.

- Do you have stock options that you need to exercise this year? Do you have a plan?

- As you plan for your 2023 taxes, are there things you can do differently in 2024?

- Equity and bond markets are still correlated. Do you have enough diversification in your portfolio to cushion against downturns?

Planning ahead and starting early are tried and true methods to keep you tracking to your goals. As the year gets going, it’s easier to achieve your goals if you have a clear outline of what you want to do, how to do it, and you automate as much as possible.

Wishing you a Happy and Healthy New Year!

January Market Commentary – Is Rate Relief In Sight?

January Market Commentary – Is Rate Relief In Sight?

December Recap and January Outlook

The drama around the timing of the Federal Reserve’s first cuts to the key short-term interest rate continued in last few weeks of the old year and into the first week of the new year.

Two months of slowing labor market data, coupled with a change to the wording in the December FOMC statement that seemed to indicate the Fed is done tightening interest rates had futures markets pricing in an almost 80% chance of a rate cut at the March meeting.

And then December non-farm payrolls boomed past estimates and the Board of Labor’s report showed that wages are again outpacing inflation.

Are rates still likely to come down in 2024? The Fed’s dot plot, also from the final meeting in 2023, showed a projected 2.5% interest rate cut by year end 2026, with the median position projecting a 75 basis point decrease in 2024, a further 100 basis points in 2025, and the final 75 basis points in 2026.

The prospect of cutting interest rates while the economy is still growing, even if more slowly, would mean that the unicorn “soft landing” has been reached. Inflation has come down, but despite displaying more confidence that the already enacted rate cuts are doing the intended work, Powell left the door open by describing the “last mile” of getting inflation back to 2% as more difficult, since the supply side of the equation has normalized and moderating demand is now even more important.

Let’s get into the data:

What Does the Data Add Up To?

After a nine-week positive streak largely fueled by growing confidence that the end of the rate-tightening regime was near, and the new year would bring a rapid series of rate cuts, equity markets came down to earth a little bit as the month began. Expectations of a March rate cut may have been unrealistic, but pushing cuts out further into the year still seems to be on the table.

Ensuring that inflation continues to descend to the 2% realm is the Fed’s priority, and one factor that has dogged Powell in that fight is the perception of consumers of the likely path and timing of inflation. Powell’s fear has been sticky, entrenched inflation that doesn’t respond to policy. With housing costs finally seeing some relief, and prices beginning to deflate, consumers are finally starting to have a different view.

The Federal Reserve Bank of New York’s Survey of Consumer Expectations, which was released on January 8th, shows that inflation expectations for one year from now declined to the lowest level since January 2021. Consumers now think inflation will be at 3% by next January. Consumer views on inflation are an important factor in policy determination, because inflation can be a self-fulfilling prophecy. If consumers think inflation will continue to rise, they purchase more now in the belief that things will cost more later. An expectation of falling inflation can lead to consumers postponing purchases, which can help organically slow the economy.

In the best-case scenario for the end of 2024, according to the Fed’s projections, PCE inflation hits 2.4% (still high) interest rates fall to 4.25%-4.50% (still higher) and unemployment rises to a little over 4%. The economy will slow, but still grow, and if there is a recession, it will be mild.

The wild cards? A domestic election year, gas prices that are vulnerable to increasing geopolitical tensions, and the potential that the massive increases in interest rates have more of an impact on the economy than what we’ve seen so far. We’re already seeing this in the housing market, as higher mortgage rates have slowed sales.

Chart of the Month: Labor Outstrips Expectations

After two months of moderating job gains, December was outstripped expectations. However, the impact of the gain on investors’ expectations for a rate cut in March may be more significant than the message for the labor markets. The last two month’s number were revised down a bit, and the total average monthly payroll employment increase was 225,000 in 2023, compared to 399,000 in 2022.

Source: U.S. Department of Labor data, unrevised. Chart: Axios Visuals

Equity Markets in December

The S&P 500 was up 4.42% for the month and ended the year up 24.32%

Source: S&P Global. All performance as of December 31, 2023

Equity markets closed out the year with enough positive performance to wipe the double-digit losses in 2022 off the slate. At the sector level, there were still winners and losers, with Information Technology out in front with a return over the two-year period (2022 and 2023) of 11.18%. Despite a loss of 4.80% in 2023, Energy has return to burn over the two-year period, up 51.41%. Utilities were the biggest loser, down 11.49% in the combined period.

Bond Markets

The 10-year U.S. Treasury ended the month at a yield of 3.88%, down from 4.34% the prior month. The 30-year U.S. Treasury ended December at 4.04%, down from 4.50%. The Bloomberg U.S. Aggregate Bond Index returned 3.83%, pushing the year-to-date return 5.15%.

The Smart Investor

This time of year, good intentions, new goals, and lots of buying organization aids are at the top of everyone’s lists. While buying boxes to store your holiday decorations, or a new planner, or any of the myriad options to organize your life, your time and your stuff are all good ideas, getting your financial life renovated or at least tidied up will keep you on track with everything else you want to make happen in 2024.

There’s a lot to do, but don’t try to do it all at once. Think about your financial plan along with your life goals, and tackle things as they come up.

Planning ahead and starting early are tried and true methods to keep you tracking to your goals. As the year gets going, it’s easier to achieve your goals if you have a clear outline of what you want to do, how to do it, and you automate as much as possible.

Wishing you a Happy and Healthy New Year!

RECENT ARTICLES

Do You Need an LLC for a Rental Property Investment?

The Five Key Components of Financial Literacy

April Market Commentary What a Long, Strange Trip It’s Been

Real Estate Investing: What Is a 1031 Exchange into a DST?

529 Plans and SECURE 2.0: More Flexibility