April Recap and May Outlook

April had it all, and most of it was not so great. Inflation is proving sticky again, which forced the market and the Fed to reassess the timing of interest rate cuts.

Conflicts intensified in Ukraine and the Middle East, and in the U.S., protests on college campuses hit a crisis point as police were called in to clear building takeovers and encampments. The protests recall the summer of 2020 and may have an outsize impact on policy in an election year.

Although equity markets struggled, the S&P 500 remained over the 5,000 level, usually a key psychological as well as market threshold.

CPI for March came in higher than expected, following an increase in February. By months’ end, the markets had moved from expecting the Fed to cut rates in May to having a relief rally when, in his comments after the April 30/May 1 FOMC, Fed Chairman Powell said it was unlikely that a rate hike would be the response to the changed inflation picture.

Let’s get into the data:

- CPI stickiness increased. CPI rose 3.5% for the 12 months through March. Core CPI, excluding food and energy, rose 3.8%, the same as in February but above consensus expectations

- Quarterly GDP came in well under economists’ forecasts of 2.4%. Gross domestic product increased at a 1.6% annualized rate last quarter, the Commerce Department’s Bureau of Economic Analysis reported in its “advance” estimate

- Annual GDP forecasts were recently upgraded by the IMF. The International Monetary Fund is forecasting 2024 U.S. growth of 2.7%, up from the 2.1% projected in January

- Non-farm payrolls increased by 175,000 jobs in April. The Labor Department’s Bureau of Labor Statistics report was below consensus expectations. Economists had expected an estimated 235,000 jobs

What Does the Data Add Up To?

A lower GDP number, indicating a slowing economy, paired with higher inflation and a booming March labor market raised concerns about entering a period of stagflation, when the economy struggles and inflation remains untamed. Fed Chairman Powell put those fears to rest in his remarks after the most recent FOMC meeting when he pointed to economic growth at 3% by some measures and inflation below 3%. Powell is referring to PCE inflation, the Fed’s preferred measure, which came in at 2.7% annually at the end of March.

Despite Powell’s view that stagflation is not likely, his optimism did not extend to getting inflation down closer to 2%. Powell noted that “So far this year, the data have not given us that confidence.” While it was good news to hear that further rate hikes are likely not on the table, Powell was careful to indicate that the Fed is prepared to wait longer than previously expected before cutting rates.

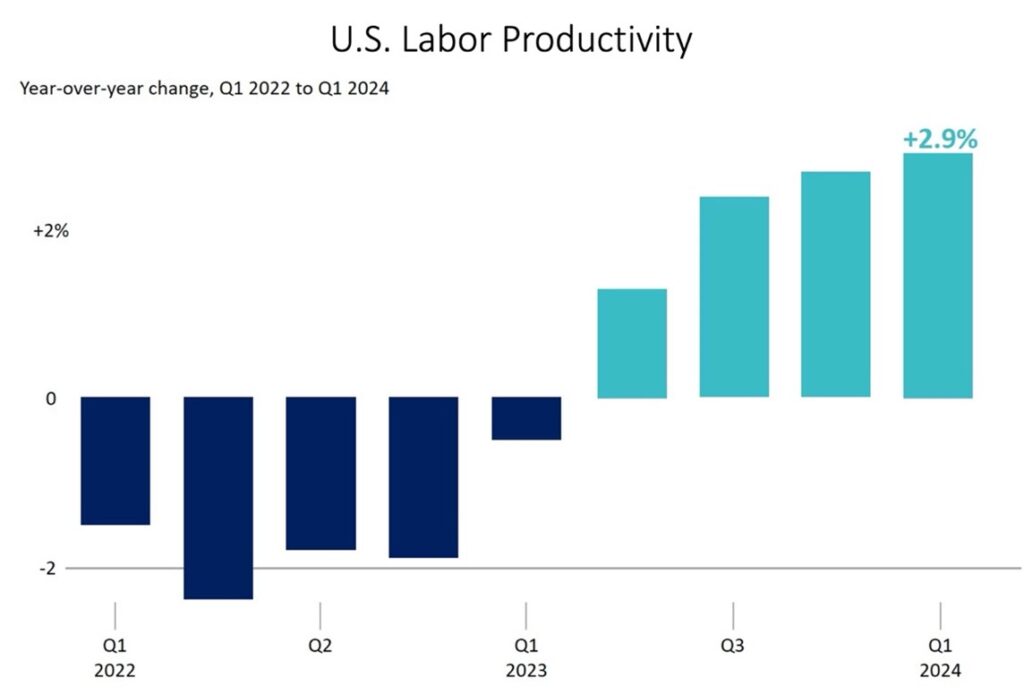

Chart of the Month: Productivity Could Create a Goldilocks Economy

Surging productivity over the last year has helped in the battle against inflation. If it continues at this level – even if further quarterly increases are minimal – it may be enough for the U.S. economy to continue to see strong growth and falling inflation.

Source: Data: U.S. Bureau of Labor Statistics; Chart: Axios Visuals

Equity Markets in April

- The S&P 500 was down 4.16%

- The Dow Jones Industrial Average dropped 5.00%

- The S&P MidCap 400 lost 6.08%

- The S&P SmallCap 600 was down 5.71%

Source: S&P Global. All performance as of April 30, 2024

Only one of the eleven S&P 500 sectors gained in April, despite earnings coming in better than expected with 76.8% of companies beating expectations. Utilities was the strongest performer, up 1.59% for the month, and Real Estate turned in the highest loss, down 8.62%. Volatility as measured by the daily high/low increased dramatically, from 0.73% in March to 1.13% in April.

Bond Markets

The 10-year U.S. Treasury ended the month at a yield of 4.68%, up from 4.21% the prior month. The 30-year U.S. Treasury ended April at 4.75%, up from 4.35%. The Bloomberg U.S. Aggregate Bond Index returned -2.53%. The Bloomberg Municipal Bond Index returned -1.24%.

The Smart Investor

Summer is almost here, and enjoying good weather, kids out of school, and vacations are the best ways to recharge. You’ll enjoy your vacation time more if you attend to some financial chores before you get the summertime vibes underway.

- If you have college-bound kids, the FAFSA deadline is June 30, 2024. There’s a new FAFSA form that is much simpler and there have been some changes, so even if you think you won’t qualify, you should fill it out

- Vacations are meant to rest and recharge you, but if you overspend the good effect may be shortlived. Make a vacation budget, and prioritize in advance the things you really want to do. This can help keep you on track when the in-the-moment fun takes over. Don’t forget to include the impact of kids home from college on your weekly basic spending when setting your limits

- Think about your household expenses and maintenance. Are there DIY tasks you can save on? Alternatively, are there big jobs that will save you money in the long run? How are you funding them? Reviewing your cash flow plan can help you understand where you are spending and how you can free up funds, or invest in ways that can potentially create more

Keeping your finances on track with your goals is something you don’t want to think about all the time, but focusing on it can ensure you create the flexibility you want throughout your financial journey. If you have questions, we’re always here to help.

May Market Commentary – A New POV Takes Hold

May Market Commentary – A New POV Takes Hold

April Recap and May Outlook

April had it all, and most of it was not so great. Inflation is proving sticky again, which forced the market and the Fed to reassess the timing of interest rate cuts.

Conflicts intensified in Ukraine and the Middle East, and in the U.S., protests on college campuses hit a crisis point as police were called in to clear building takeovers and encampments. The protests recall the summer of 2020 and may have an outsize impact on policy in an election year.

Although equity markets struggled, the S&P 500 remained over the 5,000 level, usually a key psychological as well as market threshold.

CPI for March came in higher than expected, following an increase in February. By months’ end, the markets had moved from expecting the Fed to cut rates in May to having a relief rally when, in his comments after the April 30/May 1 FOMC, Fed Chairman Powell said it was unlikely that a rate hike would be the response to the changed inflation picture.

Let’s get into the data:

What Does the Data Add Up To?

A lower GDP number, indicating a slowing economy, paired with higher inflation and a booming March labor market raised concerns about entering a period of stagflation, when the economy struggles and inflation remains untamed. Fed Chairman Powell put those fears to rest in his remarks after the most recent FOMC meeting when he pointed to economic growth at 3% by some measures and inflation below 3%. Powell is referring to PCE inflation, the Fed’s preferred measure, which came in at 2.7% annually at the end of March.

Despite Powell’s view that stagflation is not likely, his optimism did not extend to getting inflation down closer to 2%. Powell noted that “So far this year, the data have not given us that confidence.” While it was good news to hear that further rate hikes are likely not on the table, Powell was careful to indicate that the Fed is prepared to wait longer than previously expected before cutting rates.

Chart of the Month: Productivity Could Create a Goldilocks Economy

Surging productivity over the last year has helped in the battle against inflation. If it continues at this level – even if further quarterly increases are minimal – it may be enough for the U.S. economy to continue to see strong growth and falling inflation.

Source: Data: U.S. Bureau of Labor Statistics; Chart: Axios Visuals

Equity Markets in April

Source: S&P Global. All performance as of April 30, 2024

Only one of the eleven S&P 500 sectors gained in April, despite earnings coming in better than expected with 76.8% of companies beating expectations. Utilities was the strongest performer, up 1.59% for the month, and Real Estate turned in the highest loss, down 8.62%. Volatility as measured by the daily high/low increased dramatically, from 0.73% in March to 1.13% in April.

Bond Markets

The 10-year U.S. Treasury ended the month at a yield of 4.68%, up from 4.21% the prior month. The 30-year U.S. Treasury ended April at 4.75%, up from 4.35%. The Bloomberg U.S. Aggregate Bond Index returned -2.53%. The Bloomberg Municipal Bond Index returned -1.24%.

The Smart Investor

Summer is almost here, and enjoying good weather, kids out of school, and vacations are the best ways to recharge. You’ll enjoy your vacation time more if you attend to some financial chores before you get the summertime vibes underway.

Keeping your finances on track with your goals is something you don’t want to think about all the time, but focusing on it can ensure you create the flexibility you want throughout your financial journey. If you have questions, we’re always here to help.

RECENT ARTICLES

Deferred Compensation – A Plan for Unlimited Retirement Savings

What a Weaker Dollar Means for Your Investments

June Market Commentary – The Limits of Data in an Ever-Changing Environment

Expanding Portfolio Horizons: Exploring Diversification Opportunities Beyond Major Indices

Understanding the Investment Implications of Rising Debt and Credit Downgrades