October Recap and November Outlook

An election season with several twists and turns came to a not-unexpected end with the reelection of President Donald Trump. The received wisdom is that the financial markets hate uncertainty, and we certainly saw some evidence of that in the rally that followed the decisive election results.

How will a new White House regime impact the economy and the markets going forward? President Trump is on record with his preference for lower rates, but the early market reaction seems to be more focused on potential policy implications of higher tariffs and a stronger approach to immigration portending a return to higher inflation.

The Federal Reserve will likely remain above the fray, waiting until the January changeover and for policy to become reality. However, the new (old) regime does complicate an economic picture that was beginning to look like rates would come down slowly, but definitely.

Let’s get into the data:

- Non-farm payrolls increased by 12,000 jobs in October. The Labor Department’s Bureau of Labor Statistics report was well the Dow Jones estimate of 100,000 jobs. The unemployment rate remained unchanged at 4.1%.

- Inflation as measured by CPI decreased further. CPI rose 2.4% for the 12 months ended in September, continuing the downward trend towards 2%.

- GDP rose at a 2.8% annualized rate in the 3rd quarter. Consumer spending fueled most of the increase, with personal consumption expenditures up 3.7% annualized, from 2.8% in the second quarter.

- The Conference Board’s consumer confidence index jumped 9.5 points in October. This reflects the biggest monthly gain since 2021 as consumers were more upbeat about business conditions and job availability.

- The Fed lowered rates by 25 basis points. Rates were cut by 25 basis points, with the current target rate now 4.50%-4.75%.

What Does the Data Add Up To?

The non-farm payrolls number of 12,000 jobs was the lowest since December of 2020. The impacts of the Boeing strike and hurricanes Helene and Milton were largely blamed for the weakness of the report, which was not generally seen as indicating a collapsing job market, or underlying fragility in the economy.

Consumer spending, the biggest driver of GDP, increased by a healthy 0.5% in September, reflecting the fact that even though prices are still high, household incomes are rising enough to give consumers some breathing space. Overall, the economy is looking somewhat in balance, and the new administration is inheriting low inflation, a solid job market and a positive consumer, despite the clear dissatisfaction that likely resulted at least in part in the rejection of the status quo as represented by Kamala Harris.

The immediate impact of the election was a stock market rally that included a bump for the Russell 2000 Index, as smaller firms are expected to benefit from new domestic policies. Bond yields also soared as bond prices sold off, which could indicate expectations for strong economic growth as market participants shift to a very “risk on” stance. However, it could also reflect expectations that some of the new administration’s policy choices may result in wider deficits that will fuel inflation and higher interest rates.

The Federal Open Market Committee meeting was scheduled for two days after the election, and as anticipated, the committee approved a 25-basis point rate cut. At the press conference, Chairman Powell stated that “the downside risks to economic activity have been diminished” but reiterated that the Fed is awaiting incoming data before deciding on rates at the December meeting. Powell stated that the Fed is looking to be on a “middle path” between keeping inflation trending down and ensuring the labor market remains solid. In the statement accompanying the meeting, two references to inflation were deleted. Powell stated that these changes were not meant to convey a signal on further guidance, as the pace and the destination of rate cuts is still uncertain.

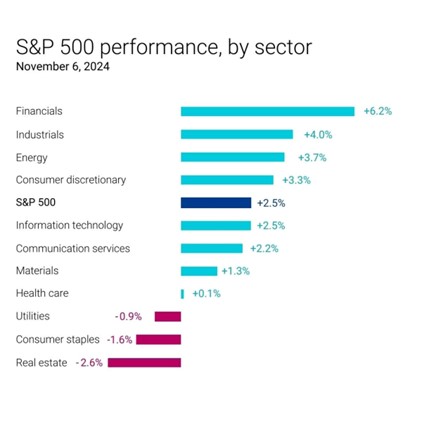

Chart of the Month: The Trump Trade

Campaign platforms may not always translate into policy, but the markets were very clear in taking things the president has said and translating that into action.

Source: Data, FactSet vis WSJ; Chart: Axios Visuals

Equity Markets in October

- The S&P 500 was down 0.99% for the month

- The Dow Jones Industrial Average fell 1.34%

- The S&P MidCap 400 decreased 0.77% for the month

- The S&P SmallCap 600 declined 2.71%

Source: S&P Global. All performance as of October 31, 2024

After a positive month, the S&P 500 saw more of a “trick” on Halloween than a “treat,” as the Magnificent 7 gave up most of its gains and took the index into the red. eight of the eleven GICS sectors turned in positive performance. Three of eleven sectors were positive, with Financials up 2.55% for the month and in first place. Healthcare was the worst performer, with -4.73% return for the month. Over 72% of S&P 500 issues reported by month end, and Q3 earnings and sales are both projected to set new quarterly records. Earnings are projected to extend the record-setting well 2025.

Bond Markets in October

The 10-year U.S. Treasury ended the month at a yield of 4.29%, down from 3.78% the prior month. The 30-year U.S. Treasury ended October at 4.48%, up from 4.13%. The Bloomberg U.S. Aggregate Bond Index returned -2.48%. The Bloomberg Municipal Bond Index returned -1.46%.

The Smart Investor

The election results will likely dominate the news cycle over the next few months, but for investors, this end of year period should be focused on keeping personal goals on track:

- Are your tax-advantaged savings account contributions at the level you want? With only a few pay periods left, it’s important to maximize these contributions to take advantage of time in the market and lower your taxes

- It’s time to think about charitable contributions that need to be made before year-end. If charitable giving is part of your financial plan, have you considered setting up a Donor Advised Fund?

- There will be uncertainty around interest rates as the new administration’s policies become clearer. But rethinking your cash holdings is something that can make sense, as rates are poised to come down even if the timing isn’t clear

- There may be volatility driven by the news cycle. Staying focused, staying invested, and putting a priority on your own plans and goals is the most important thing

Combining personal goals, investments, and a view on the economy is at the core of what a financial advisor can bring to the table. We’re always here to help.

November Commentary – A Historic Election Removes Some Uncertainty

November Commentary – A Historic Election Removes Some Uncertainty

October Recap and November Outlook

An election season with several twists and turns came to a not-unexpected end with the reelection of President Donald Trump. The received wisdom is that the financial markets hate uncertainty, and we certainly saw some evidence of that in the rally that followed the decisive election results.

How will a new White House regime impact the economy and the markets going forward? President Trump is on record with his preference for lower rates, but the early market reaction seems to be more focused on potential policy implications of higher tariffs and a stronger approach to immigration portending a return to higher inflation.

The Federal Reserve will likely remain above the fray, waiting until the January changeover and for policy to become reality. However, the new (old) regime does complicate an economic picture that was beginning to look like rates would come down slowly, but definitely.

Let’s get into the data:

What Does the Data Add Up To?

The non-farm payrolls number of 12,000 jobs was the lowest since December of 2020. The impacts of the Boeing strike and hurricanes Helene and Milton were largely blamed for the weakness of the report, which was not generally seen as indicating a collapsing job market, or underlying fragility in the economy.

Consumer spending, the biggest driver of GDP, increased by a healthy 0.5% in September, reflecting the fact that even though prices are still high, household incomes are rising enough to give consumers some breathing space. Overall, the economy is looking somewhat in balance, and the new administration is inheriting low inflation, a solid job market and a positive consumer, despite the clear dissatisfaction that likely resulted at least in part in the rejection of the status quo as represented by Kamala Harris.

The immediate impact of the election was a stock market rally that included a bump for the Russell 2000 Index, as smaller firms are expected to benefit from new domestic policies. Bond yields also soared as bond prices sold off, which could indicate expectations for strong economic growth as market participants shift to a very “risk on” stance. However, it could also reflect expectations that some of the new administration’s policy choices may result in wider deficits that will fuel inflation and higher interest rates.

The Federal Open Market Committee meeting was scheduled for two days after the election, and as anticipated, the committee approved a 25-basis point rate cut. At the press conference, Chairman Powell stated that “the downside risks to economic activity have been diminished” but reiterated that the Fed is awaiting incoming data before deciding on rates at the December meeting. Powell stated that the Fed is looking to be on a “middle path” between keeping inflation trending down and ensuring the labor market remains solid. In the statement accompanying the meeting, two references to inflation were deleted. Powell stated that these changes were not meant to convey a signal on further guidance, as the pace and the destination of rate cuts is still uncertain.

Chart of the Month: The Trump Trade

Campaign platforms may not always translate into policy, but the markets were very clear in taking things the president has said and translating that into action.

Source: Data, FactSet vis WSJ; Chart: Axios Visuals

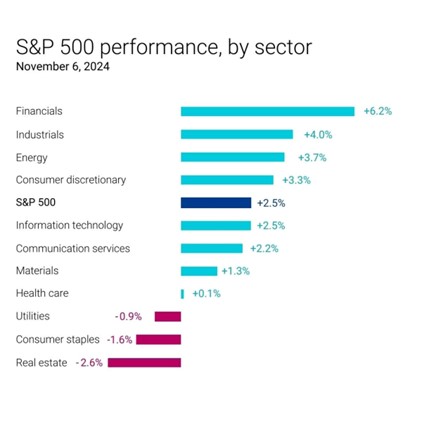

Equity Markets in October

Source: S&P Global. All performance as of October 31, 2024

After a positive month, the S&P 500 saw more of a “trick” on Halloween than a “treat,” as the Magnificent 7 gave up most of its gains and took the index into the red. eight of the eleven GICS sectors turned in positive performance. Three of eleven sectors were positive, with Financials up 2.55% for the month and in first place. Healthcare was the worst performer, with -4.73% return for the month. Over 72% of S&P 500 issues reported by month end, and Q3 earnings and sales are both projected to set new quarterly records. Earnings are projected to extend the record-setting well 2025.

Bond Markets in October

The 10-year U.S. Treasury ended the month at a yield of 4.29%, down from 3.78% the prior month. The 30-year U.S. Treasury ended October at 4.48%, up from 4.13%. The Bloomberg U.S. Aggregate Bond Index returned -2.48%. The Bloomberg Municipal Bond Index returned -1.46%.

The Smart Investor

The election results will likely dominate the news cycle over the next few months, but for investors, this end of year period should be focused on keeping personal goals on track:

Combining personal goals, investments, and a view on the economy is at the core of what a financial advisor can bring to the table. We’re always here to help.

RECENT ARTICLES

Deferred Compensation – A Plan for Unlimited Retirement Savings

What a Weaker Dollar Means for Your Investments

June Market Commentary – The Limits of Data in an Ever-Changing Environment

Expanding Portfolio Horizons: Exploring Diversification Opportunities Beyond Major Indices

Understanding the Investment Implications of Rising Debt and Credit Downgrades